Is now a good time to buy a home in Italy?

If you're looking at buying Italian property, is now the right moment? Falling interest rates and a sluggish market mean it may be as good a time as any, experts say.

High demand, low supply and a recent cut in interest rates mean more potential buyers could soon be entering the Italian property market, pushing prices further upward.

This may not seem like the ideal time to buy property - but if you're already considering a purchase, experts say it may be better to pull the trigger now.

Here's a more detailed look at why right now may (or may not) be the right time to snap up the Italian home of your dreams.

Lower mortgage rates

Italian mortgage rates are now falling after two years of steady increases. The trend, first recorded at the start of 2024, shows no sign of reversing again as we near the end of the second quarter of the year.

Lenders are confident that the European Central Bank (ECB) will soon move to further decrease inflation, meaning that Italian banks are now starting to offer mortgages at lower rates again.

READ ALSO: Can I get a mortgage in Italy as a foreigner?

Higher inflation had since 2022 pushed rates up amid the cost of living crisis, making it more expensive to buy a house and slowing down Italy's real estate market almost everywhere except for in the larger cities.

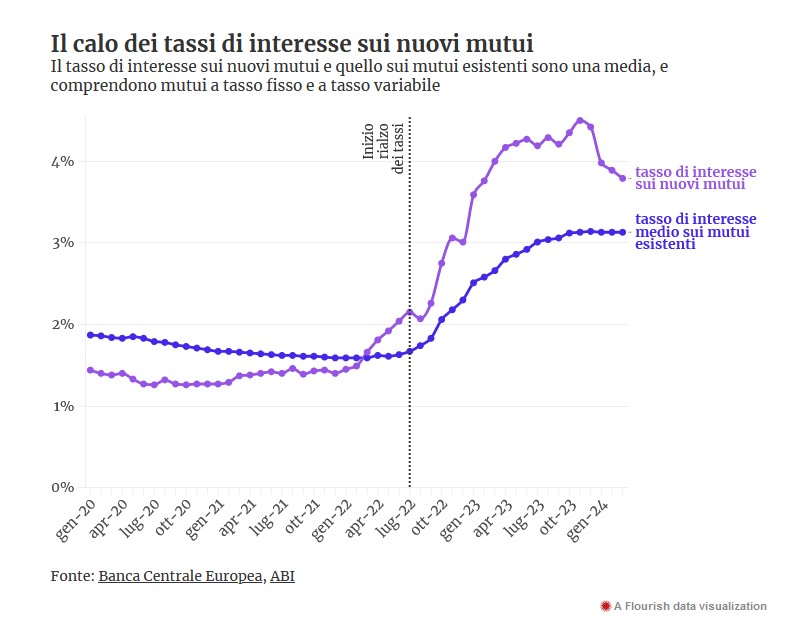

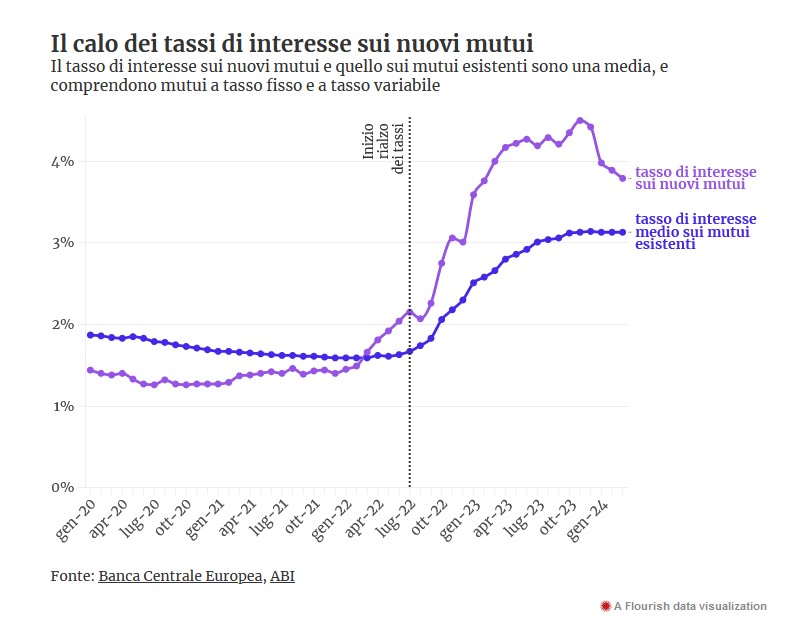

According to monthly reports from ABI, the Italian Banking Association, from November to April the average rate on new mortgages fell from 4.5 to 3.79 percent.

This decrease of 0.71 percentage points seems small, but has a significant impact on a mortgage of hundreds of thousands of euros, experts say.

“On a new 25-year loan of 150,000 euros, the corresponding saving on the monthly installment is 60 euros per month,” Guido Bertolino, head of business development at mortgage comparison portal MutuiSupermarket, tells Il Post.

Of course, this doesn't bring interest rates back down to the low levels seen until early-mid 2022, when they averaged around 1.5 percent.

Italy's average interest rates on new and existing mortgages. Image: Il Post

Rates are expected to fall further later this year following ECB announcements - but, depending on the type of mortgage you're in the market for, experts say it may be better not to wait for this to happen.

“When our clients call us and ask if it is worth waiting for further rate reductions to get a mortgage, what we explain is that future cuts will impact variable-rate mortgages only," Bertolino says.

"On fixed-rate mortgages the reduction is already evident," he says.

Slow sales

Another advantage to buying now, Bertolino points out, is that better mortgage rates will likely get the property market moving in a few months' time - and house prices are expected to rise as a result.

The Italian real estate market is coming out of a complicated two years, in which sales have been down because of the increase in interest rates.

READ ALSO: Five clever ways to find a cheap home in Italy

Many would-be buyers are believed to have postponed the purchase while waiting for rates to go down. Data from Italy's Revenue Agency on completed transactions shows that residential property sales were down 10 percent from the previous year.

The total average time needed to sell a house in Italy also increased slightly from five and a half to six months, the data showed, which suggests that it is taking longer to find a buyer.

What's happening with house prices now?

The short answer is, not a lot: as has been the trend for Italy's property market for many years.

According to official statistics bureau Istat, in 2023, house prices increased by an average of 1.3 percent: this was mainly driven by a 5.6 percent in the prices of new build homes, which remain a small part of the total number of properties available on the Italian market. Otherwise, prices remained more or less stable.

The other driver of increasing prices is location. Demand - particularly among investors - remains concentrated in large cities, according to Marzio Breglia, president of the Scenari Immobiliari research centre.

"Since 2020, the price of homes in the centre of Milan has increased by 15 percent, three times more than the Italian average," he tells Il Post.

However, he points out, this is "less than in other major European cities: In Berlin they grew by 27 percent and in Paris by 20. And so did the rents.”

READ ALSO: Five things non-residents need to know about buying property in Italy

Another sector still seeing steady growth is the international market for second homes - so if you're looking to buy from an agency specialising in this type of property, you may notice that prices per square metre are higher than average.

But Italy's property market for the most part remains bogged down by a large number of older properties which can prove difficult to sell.

Some 54 percent of Italy's housing stock is aged over 50 years, which is above the European average, according to analysis of Eurostat data by Italian financial newspaper Il Sole 24 Ore in 2021.

The rural location of most such properties, plus the amount of renovation work required, generally means there's little interest from Italian buyers.

This does mean however that international buyers who are looking to buy outside of the most popular areas may find such properties on sale at surprisingly low prices.

For anyone looking to sell an Italian property in the coming months, whether asking prices are stagnating or rising will depend on the property's location, condition, and type.

Comments

See Also

High demand, low supply and a recent cut in interest rates mean more potential buyers could soon be entering the Italian property market, pushing prices further upward.

This may not seem like the ideal time to buy property - but if you're already considering a purchase, experts say it may be better to pull the trigger now.

Here's a more detailed look at why right now may (or may not) be the right time to snap up the Italian home of your dreams.

Lower mortgage rates

Italian mortgage rates are now falling after two years of steady increases. The trend, first recorded at the start of 2024, shows no sign of reversing again as we near the end of the second quarter of the year.

Lenders are confident that the European Central Bank (ECB) will soon move to further decrease inflation, meaning that Italian banks are now starting to offer mortgages at lower rates again.

READ ALSO: Can I get a mortgage in Italy as a foreigner?

Higher inflation had since 2022 pushed rates up amid the cost of living crisis, making it more expensive to buy a house and slowing down Italy's real estate market almost everywhere except for in the larger cities.

According to monthly reports from ABI, the Italian Banking Association, from November to April the average rate on new mortgages fell from 4.5 to 3.79 percent.

This decrease of 0.71 percentage points seems small, but has a significant impact on a mortgage of hundreds of thousands of euros, experts say.

“On a new 25-year loan of 150,000 euros, the corresponding saving on the monthly installment is 60 euros per month,” Guido Bertolino, head of business development at mortgage comparison portal MutuiSupermarket, tells Il Post.

Of course, this doesn't bring interest rates back down to the low levels seen until early-mid 2022, when they averaged around 1.5 percent.

Rates are expected to fall further later this year following ECB announcements - but, depending on the type of mortgage you're in the market for, experts say it may be better not to wait for this to happen.

“When our clients call us and ask if it is worth waiting for further rate reductions to get a mortgage, what we explain is that future cuts will impact variable-rate mortgages only," Bertolino says.

"On fixed-rate mortgages the reduction is already evident," he says.

Slow sales

Another advantage to buying now, Bertolino points out, is that better mortgage rates will likely get the property market moving in a few months' time - and house prices are expected to rise as a result.

The Italian real estate market is coming out of a complicated two years, in which sales have been down because of the increase in interest rates.

READ ALSO: Five clever ways to find a cheap home in Italy

Many would-be buyers are believed to have postponed the purchase while waiting for rates to go down. Data from Italy's Revenue Agency on completed transactions shows that residential property sales were down 10 percent from the previous year.

The total average time needed to sell a house in Italy also increased slightly from five and a half to six months, the data showed, which suggests that it is taking longer to find a buyer.

What's happening with house prices now?

The short answer is, not a lot: as has been the trend for Italy's property market for many years.

According to official statistics bureau Istat, in 2023, house prices increased by an average of 1.3 percent: this was mainly driven by a 5.6 percent in the prices of new build homes, which remain a small part of the total number of properties available on the Italian market. Otherwise, prices remained more or less stable.

The other driver of increasing prices is location. Demand - particularly among investors - remains concentrated in large cities, according to Marzio Breglia, president of the Scenari Immobiliari research centre.

"Since 2020, the price of homes in the centre of Milan has increased by 15 percent, three times more than the Italian average," he tells Il Post.

However, he points out, this is "less than in other major European cities: In Berlin they grew by 27 percent and in Paris by 20. And so did the rents.”

READ ALSO: Five things non-residents need to know about buying property in Italy

Another sector still seeing steady growth is the international market for second homes - so if you're looking to buy from an agency specialising in this type of property, you may notice that prices per square metre are higher than average.

But Italy's property market for the most part remains bogged down by a large number of older properties which can prove difficult to sell.

Some 54 percent of Italy's housing stock is aged over 50 years, which is above the European average, according to analysis of Eurostat data by Italian financial newspaper Il Sole 24 Ore in 2021.

The rural location of most such properties, plus the amount of renovation work required, generally means there's little interest from Italian buyers.

This does mean however that international buyers who are looking to buy outside of the most popular areas may find such properties on sale at surprisingly low prices.

For anyone looking to sell an Italian property in the coming months, whether asking prices are stagnating or rising will depend on the property's location, condition, and type.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.